Market competitive analysis is a research process to assess product competitiveness, essential for market promotion and new product launches. A well-prepared competitive analysis report helps monitor competitors' products and market dynamics, allowing timely adjustments and optimizations to enhance product competitiveness. This article will share how to conduct market competitive analysis and outline the six steps to write a competitive analysis report using the Boardmix online whiteboard, helping you complete this task easily and efficiently!

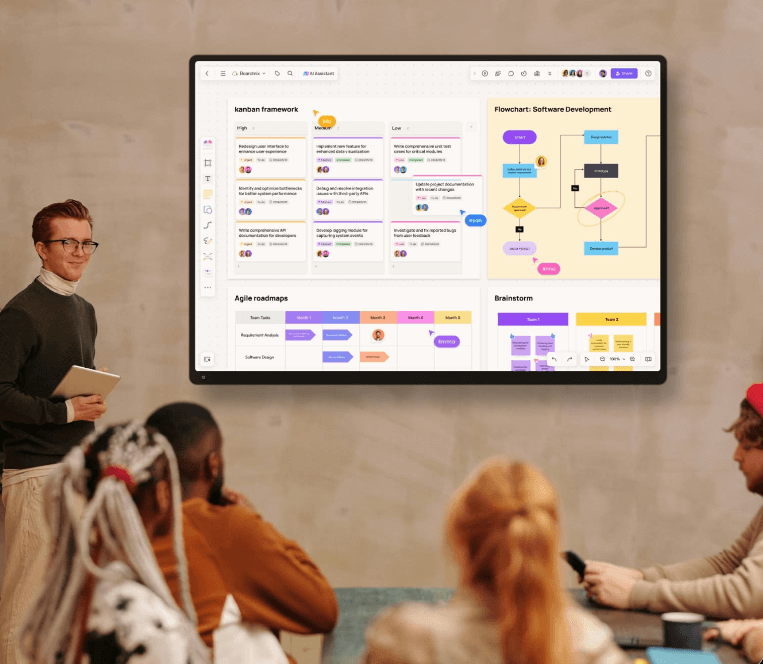

Choosing an efficient tool is crucial for competitive analysis. We recommend Boardmix for its following features:

-Visual Collaboration: Boardmix provides various visual creation tools, such as charts, shapes, sticky notes, and pens, enabling teams to create and edit competitive analysis documents collaboratively. This visual collaboration makes it easier to showcase the differences and advantages of competitors.

-Comprehensive Data Collection: Boardmix supports various file formats, including images, videos, hyperlinks, documents, spreadsheets, and charts, all of which can be visually displayed on a single platform without switching software.

-Real-Time Collaboration: Boardmix supports real-time collaboration, allowing multiple people to edit the document simultaneously. Team members can collaborate on competitive analysis tasks from different locations, improving work efficiency.

-Rich Templates and Tools: Boardmix offers various competitive analysis templates and tools, including SWOT analysis, competitive matrix, and user journey maps, helping users quickly build a competitive analysis framework and save time and effort.

-Cross-Platform Support: Boardmix is accessible on multiple platforms, including web, desktop, and mobile applications, allowing users to conduct competitive analysis work on different devices for increased flexibility and convenience.

Define the Purpose of Competitive Analysis

Identifying the goal, including market competitive analysis, is essential before starting any task. Clearly defining the purpose helps determine what competitors to analyze, what data to collect, and the dimensions and methods of analysis, laying the foundation for subsequent work and improving efficiency.

To effectively define the purpose, consider these questions:

-Definition: What product is being analyzed? What stage is the product in?

-Challenges: What problems and challenges is the product currently facing?

-Purpose: Why conduct this competitive analysis? To learn from competitors or to anticipate market trends?

-Goals: What are the goals of the competitive analysis? (e.g., product positioning, unique selling points, competitive strategies)

-Outcome: What is the expected output of the competitive analysis?

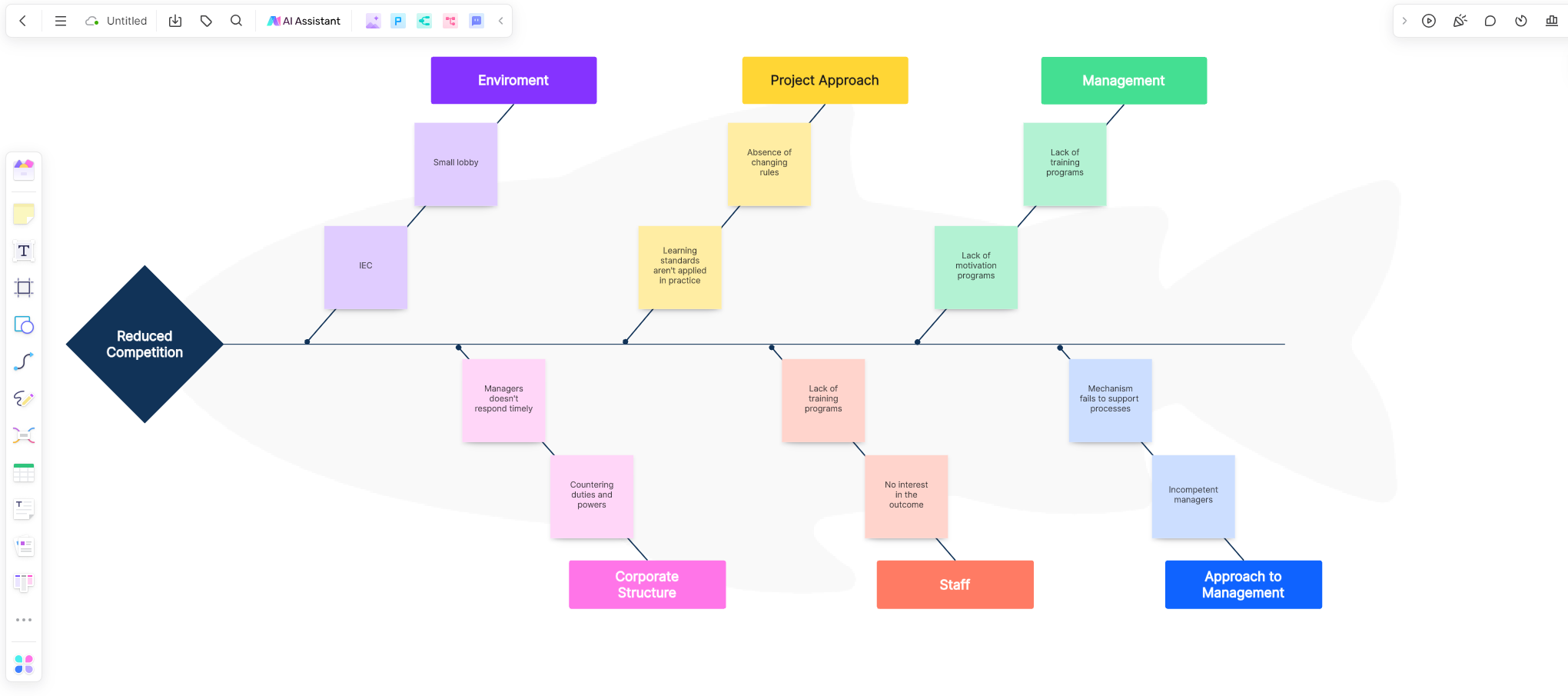

Using the Fishbone Diagram template in Boardmix, you can break down these questions and use the diagram's structure to brainstorm and define the purpose of the competitive analysis. This tool is not only useful for identifying problems but also for developing solutions.

Identify Competitors to Analyze

The key to market competitive analysis is selecting the right competitors. Choosing the wrong competitors renders the analysis meaningless. For example, it analyzes a famous brand's lipstick but chooses competitors that make skincare products like creams and lotions.

Select competitors based on product type and function, generally from the following dimensions:

Direct Competitors: Products similar in form and user group.

Important Competitors: Products better than yours in some aspects.

Core Competitors: Products that are significantly better and more competitive.

Indirect Competitors: Products different in form but similar in a target user group.

General Competitors: Products not as good as yours.

Substitutes: Products that occupy the same time or disrupt similar user habits (e.g., traditional film vs. digital cameras).

From a macro perspective, choose competitors based on:

-Market share leaders.

-Products backed by large enterprises.

-Products identified through user feedback.

-Pioneers in the product field.

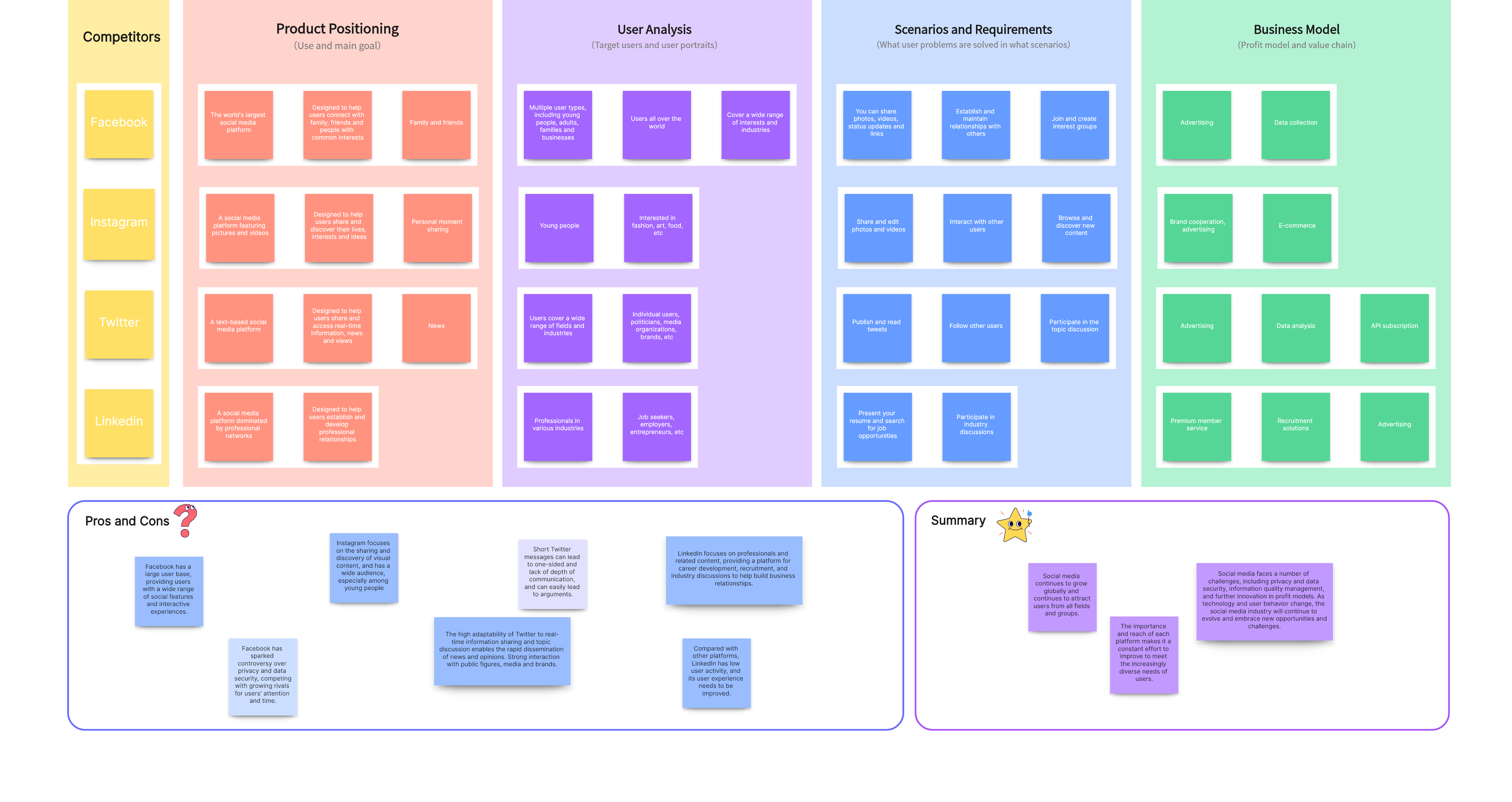

Use Boardmix's Concept Map template to break down these dimensions clearly and intuitively.

Once you've identified the dimensions, gather competitor information from the following sources:

-App Store categories and application malls.

-Industry media.

-Industry analysis reports.

-Online competitive analyses.

-Various search engines.

Determine Analysis Dimensions

Specify the dimensions of the analysis to define its direction and content. Typically, competitive analysis can be approached from:

Product Dimensions:

-Function design: Analyze up to three levels of functionality.

-User experience: Including page layout, color schemes, logo design, content quality, and interaction design.

-User demographics: User profiles, usage data, and feedback.

-Revenue models: Common models include freemium, advertising, e-commerce, and lifecycle costs.

-Market promotion: Product selling points, pricing, sales channels, and marketing strategies.

-Team background: Team composition, resources, technical background, and barriers.

-Planning: Competitor’s plans, derived from financial reports, funding, and recruitment.

-Corporate strategy: Predicting next product moves based on strategic goals.

User Experience Dimensions:

-Basic information about the competitor (company background, history, operational data).

-Product positioning and target users.

-Information architecture and main functionalities.

-Visual and interaction design.

-Marketing and promotional strategies.

Collect Competitor Data

Having identified the competitors, start gathering data. Collect information from these six directions:

-Official sources: Competitor websites, public disclosures, executive speeches.

-Industry research: Industry analysis reports from sources like iResearch, Analysys, and Penguin Intelligence.

-Data platforms: DCCI, Baidu Index, Qimai Index, AppAnnie.

-Media sources: Industry media, forums, news reports.

-Relevant personnel: Surveys and interviews with core users and employees.

-Personal trials: Using competitor products, consulting customer service, reading reviews.

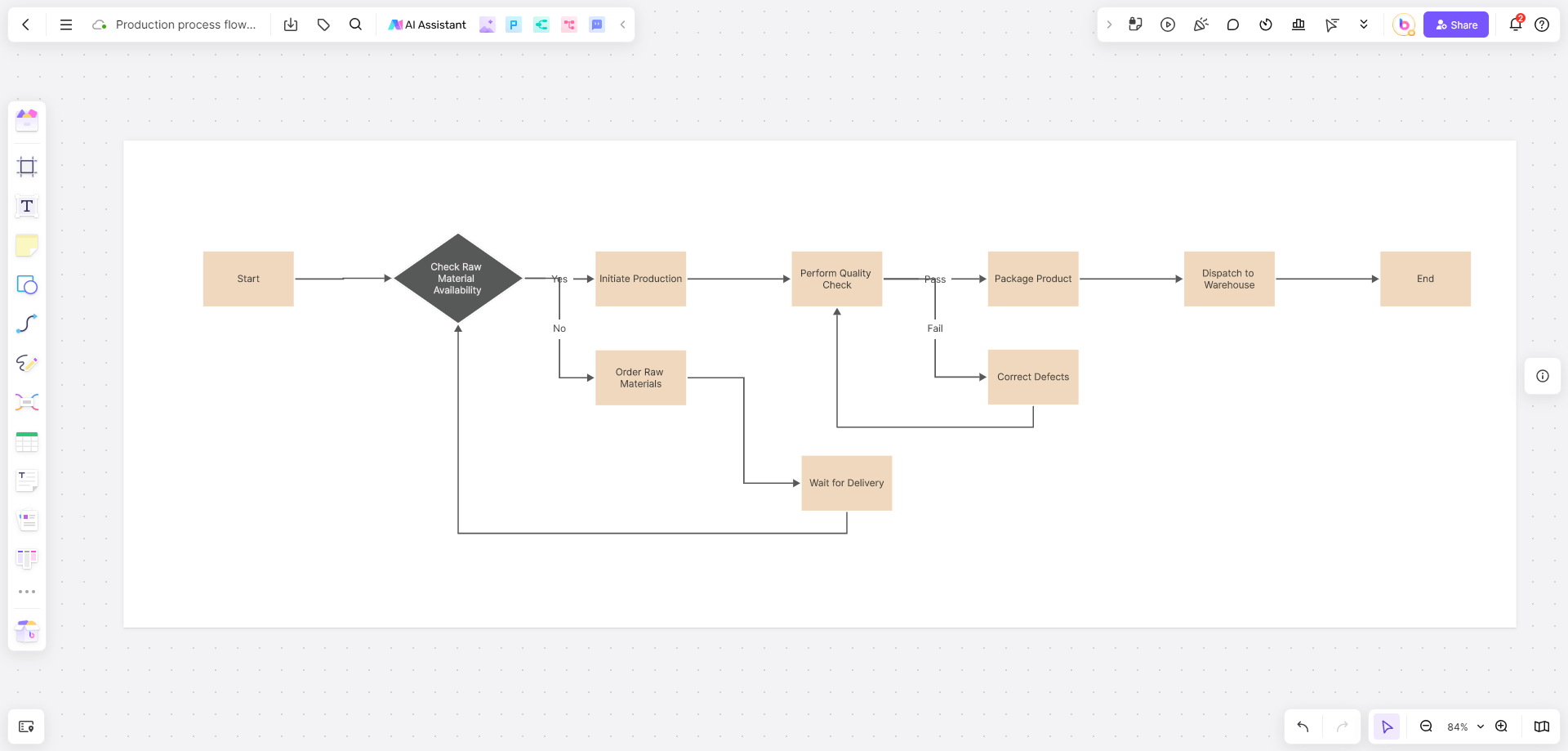

To manage large volumes of data, Boardmix can help store and organize information. It supports hyperlinks, file formats, and images, allowing easy data organization and intelligent layout.

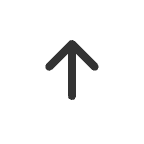

Organize and Analyze Information

Data analysis is crucial, and different stages require different methods. Using Boardmix’s templates, here are common methods:

Strategic Planning Stage:

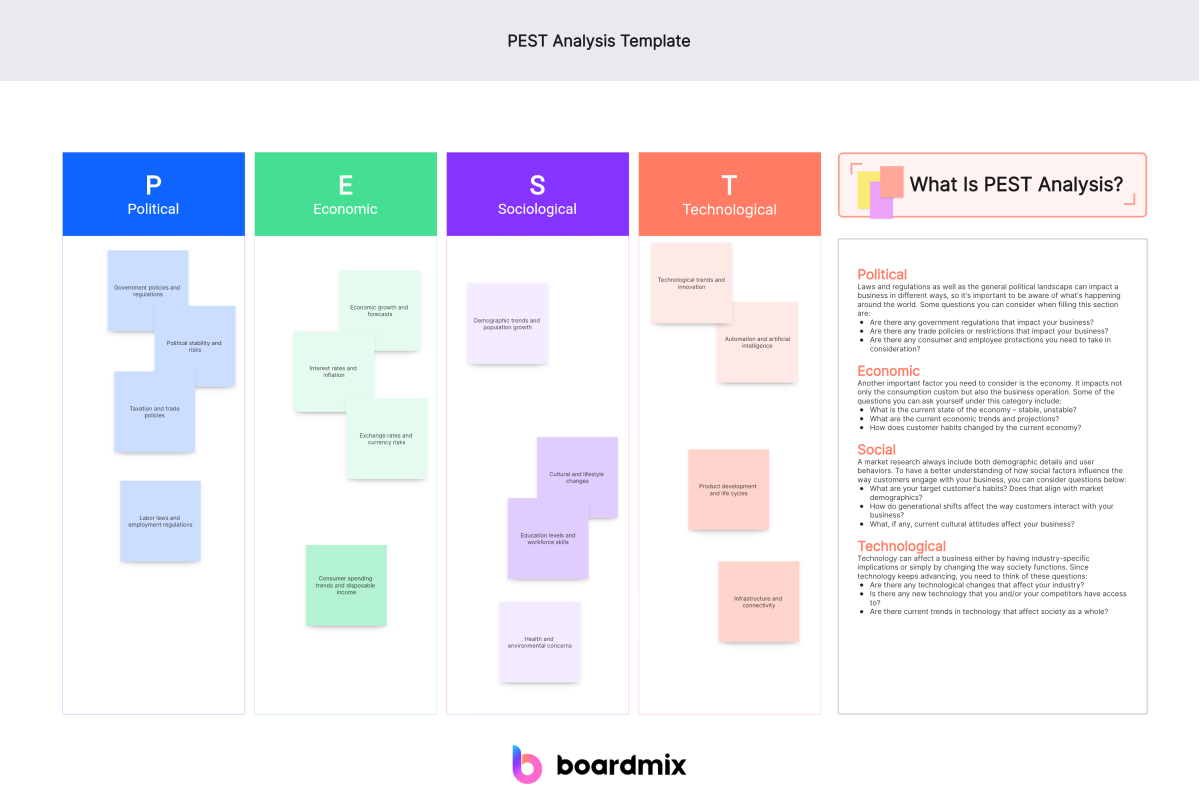

PEST Analysis: Evaluate from political, economic, social, and technological perspectives.

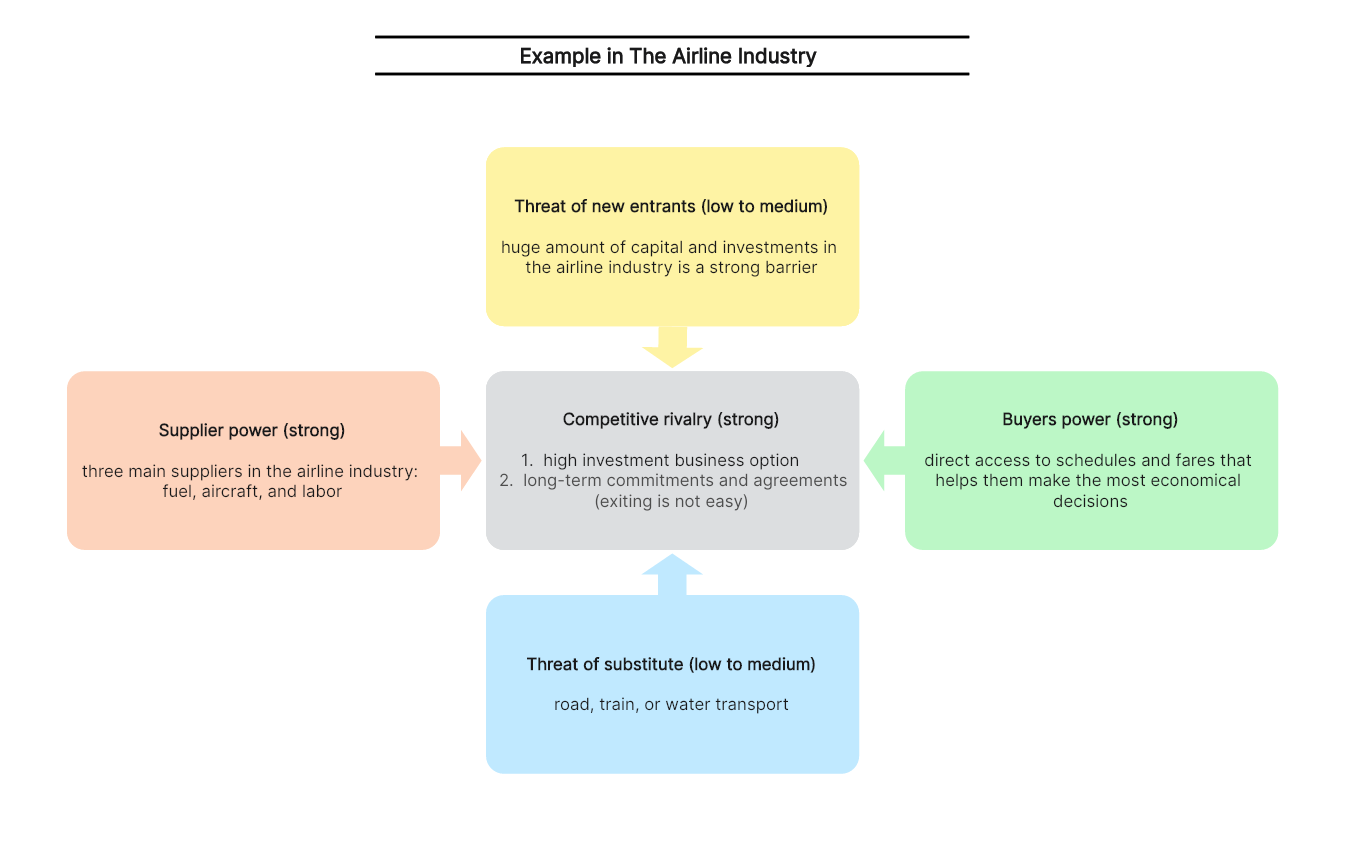

Porter’s Five Forces: Assess the industry environment by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and competitive rivalry.

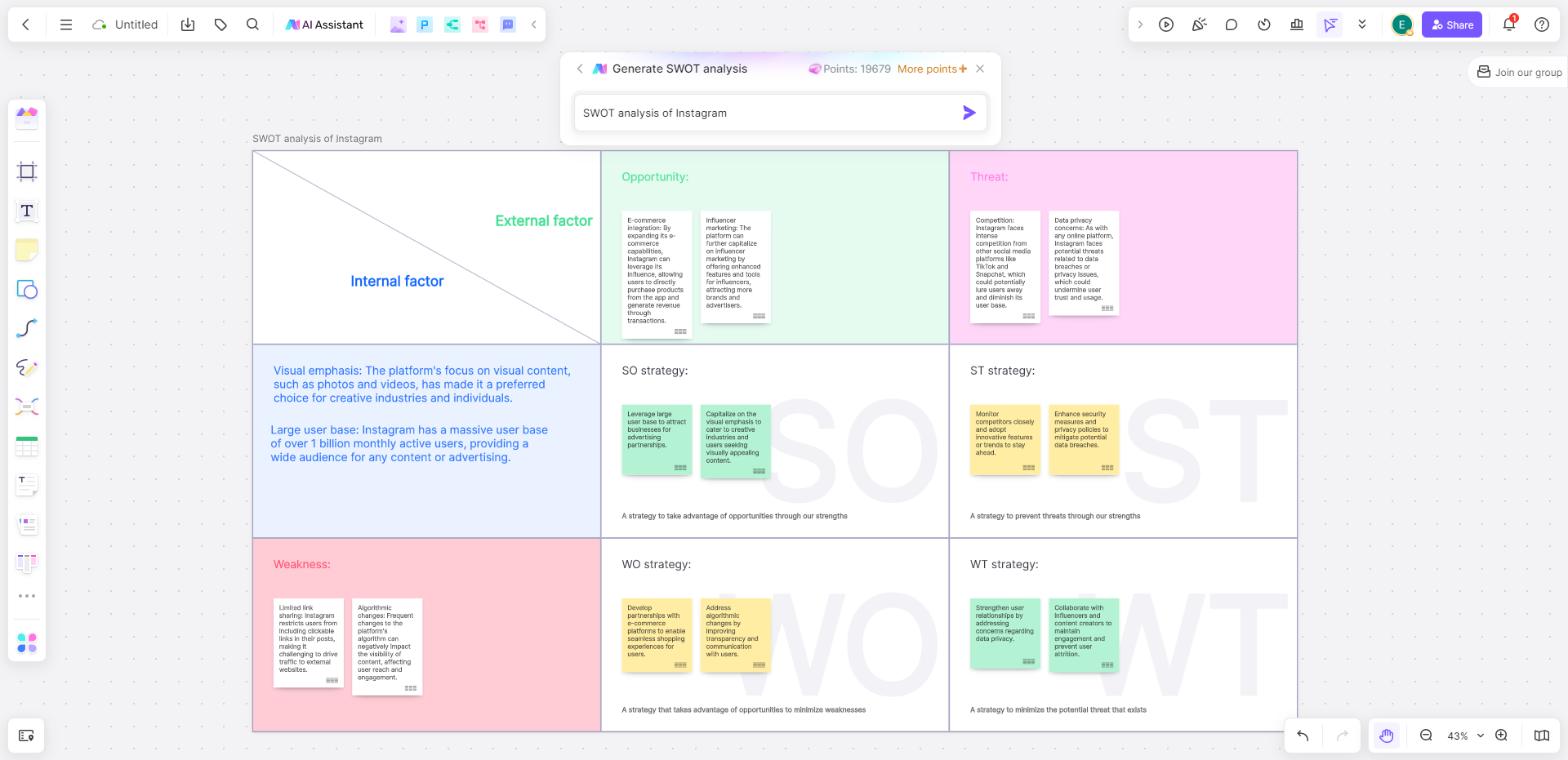

SWOT Analysis: Analyze strengths, weaknesses, opportunities, and threats.

Product Development Stage:

Focus on improving the product by learning from competitors.

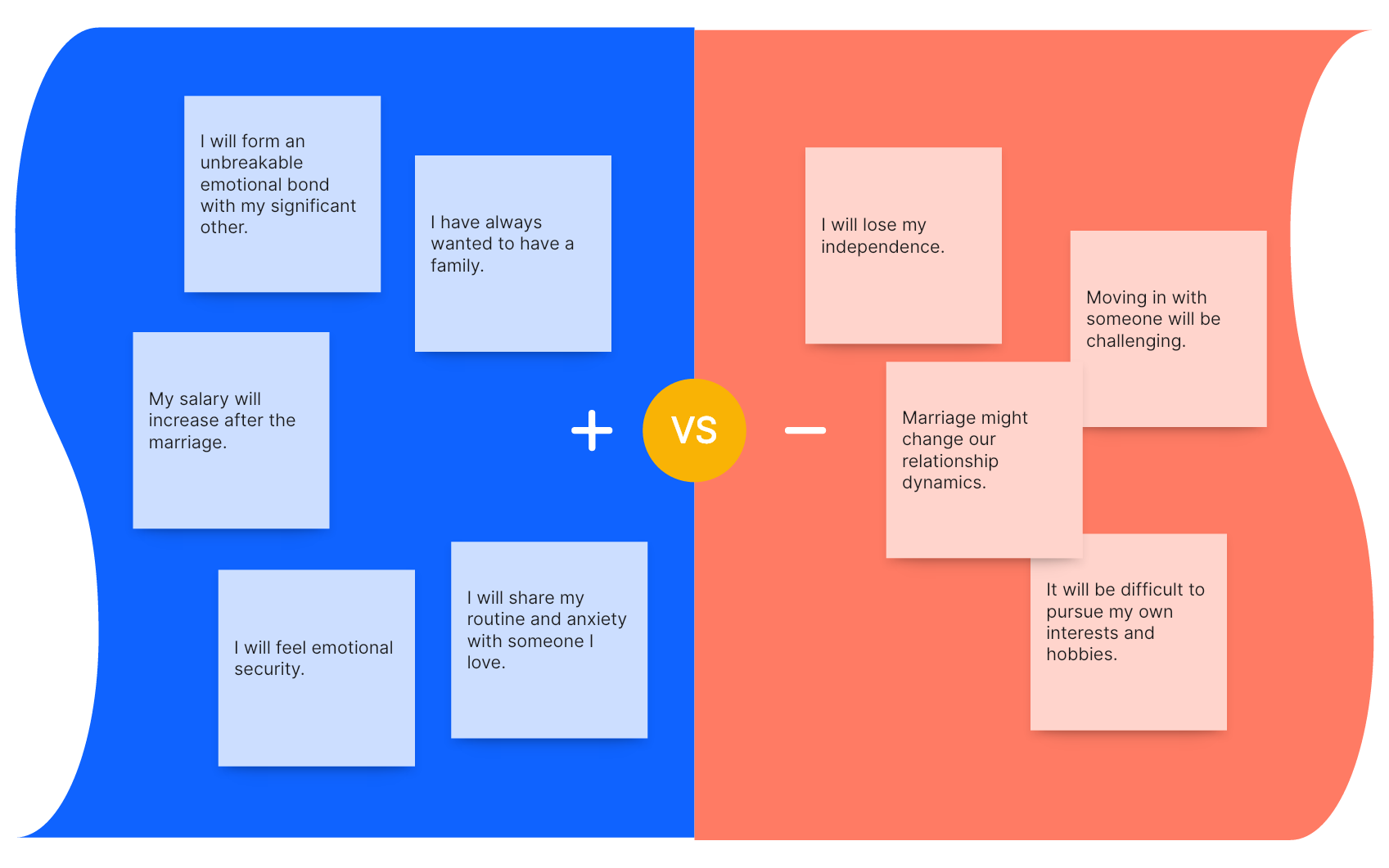

Comparative Methods: Identify strengths and weaknesses through direct comparison.

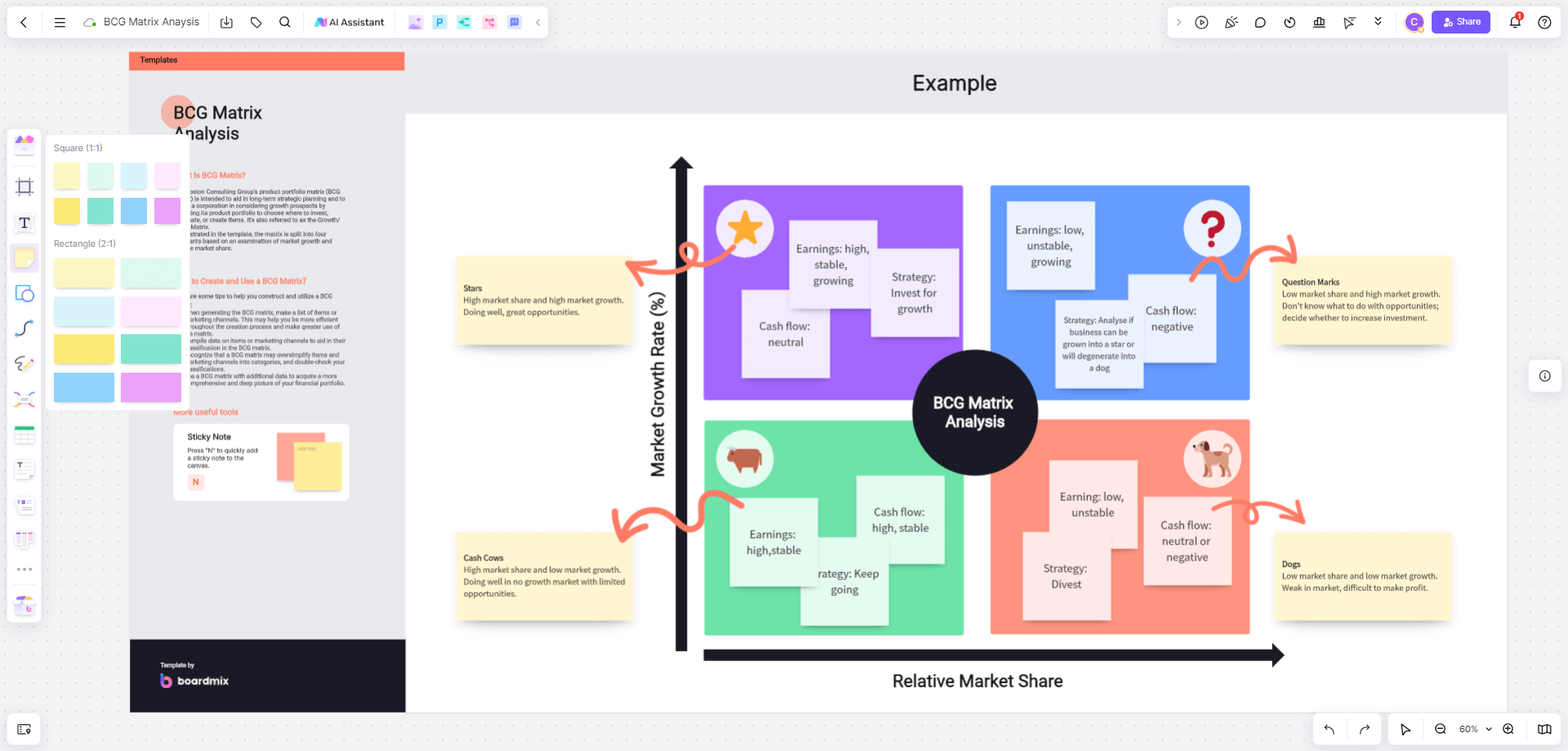

Matrix Analysis: Use a two-dimensional matrix to evaluate product positioning and market opportunities.

Severe Product Homogeneity Stage:

Strategic Canvas: Compare competitive elements and visualize product performance across various dimensions.

Add-Subtract-Multiply-Divide Method: Identify elements to enhance, reduce, create, or innovate compared to competitors.

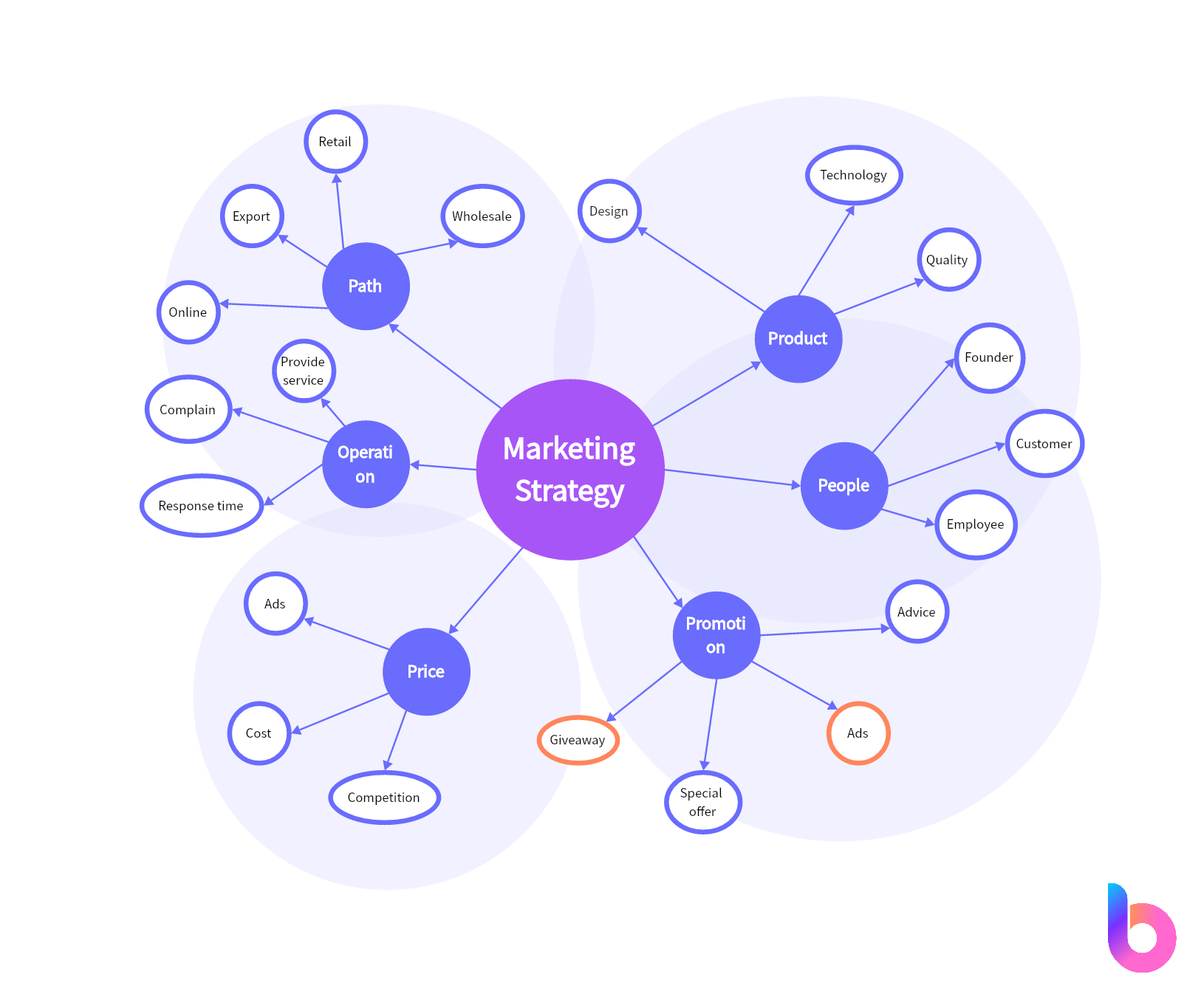

Produce the Competitive Analysis Report

Consider the following to create a comprehensive competitive analysis report:

-Who are the users?: Identify the audience for the report.

-What is the context?: Determine the setting for using the report and how to enhance user experience.

-What problems does it solve?: Define the issues addressed by the analysis and ensure the report’s recommendations are actionable.

Given the extensive workload, competitive analysis requires not only an understanding of the six key steps but also effective team collaboration and tools. Boardmix’s online collaboration whiteboard provides numerous templates for various scenarios, reducing the effort needed to design analysis frameworks.

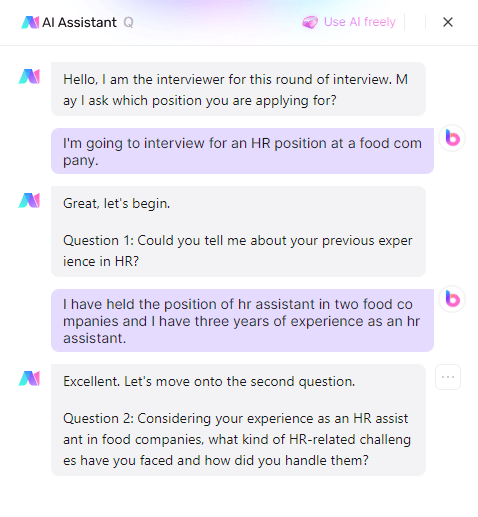

Moreover, Boardmix offers AI capabilities, such as generating PPTs, mind maps, and intelligent dialogues. Simply input the title, and the tool can automatically create a competitive analysis report. Register now to access free AI features and start your experience with Boardmix!