Financial management plays a pivotal role in steering an organization towards its goals. Key to effective financial management is the ability to monitor and measure performance to inform strategic decisions. This is where scorecards, particularly Balanced Scorecards, come into play. In this article, we explore what a scorecard in financial management is, why the Balanced Scorecard is critical in finance, and how to better utilize this tool.

What Is a Scorecard in Financial Management

In the realm of financial management, a scorecard is a performance measurement framework that provides a balanced view of an organization's financial performance. Unlike traditional reporting tools that focus mainly on financial metrics, a scorecard captures a wide range of factors contributing to an organization's overall performance.

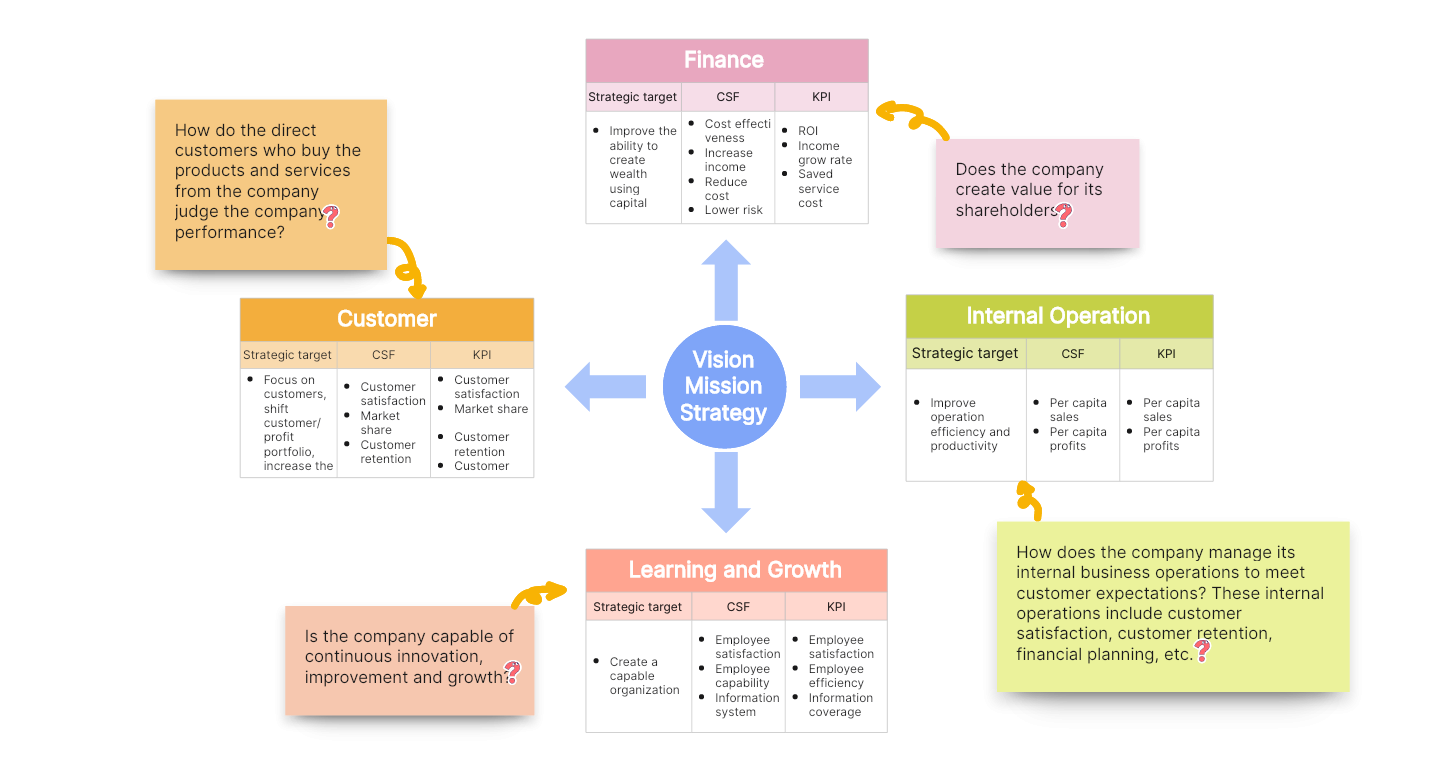

There are different types of scorecards, but the most commonly used is the Balanced Scorecard. Created by Robert S. Kaplan and David P. Norton, the Balanced Scorecard integrates financial measures with other key performance indicators related to customers, internal processes, and learning and growth.

In a Balanced Scorecard, the financial perspective focuses on how an organization's activities contribute to improving short- and long-term financial performance. Key metrics might include net profit, return on investment (ROI), cost reduction, revenue growth, and cash flow.

Why Is a Balanced Scorecard Important in Finance

The Balanced Scorecard's importance in finance cannot be overstated for several reasons:

- Comprehensive View of Performance: A Balanced Scorecard goes beyond traditional financial measures to provide a more comprehensive view of organizational performance. It integrates non-financial measures related to customers, internal processes, and learning and growth, offering insights into how these elements impact financial results.

- Improved Decision Making: By providing a balanced view of performance, the Balanced Scorecard supports more informed decision making. It helps identify areas of strength and weakness across the organization and directs attention to areas that need improvement.

- Alignment of Activities with Strategy: The Balanced Scorecard ensures that operational activities are aligned with the organization's strategic objectives. It translates the strategy into tangible objectives and measures, ensuring everyone understands what needs to be achieved.

- Enhanced Communication: By visualizing key objectives and measures, the Balanced Scorecard facilitates communication of the strategy throughout the organization. This enhances understanding and buy-in from employees at all levels.

A scorecard, particularly a Balanced Scorecard, is an integral part of financial management. It not only measures financial performance but also provides insights into non-financial aspects that influence results. This comprehensive view enables better strategic decisions, leading to improved financial performance and organizational success.

How to Measure Financial Performance in a Balanced Scorecard

As one of the BSC’s core components, financial performance measurement plays a vital role. In this section, we will delve into how to effectively measure financial performance within a BSC.

Identifying Relevant Financial Measures

Identifying relevant financial measures depends on the nature of your business and your strategic objectives. However, commonly used financial metrics in a BSC include:

- Profitability Measures: These could include net profit margin, gross profit margin, operating profit margin, return on assets (ROA), and return on investment (ROI). These measures help gauge your business's ability to generate profits relative to its costs.

- Efficiency Measures: Metrics such as inventory turnover, accounts receivable turnover, or asset utilization ratios can provide insights into how efficiently your business is utilizing its resources.

- Growth Measures: Revenue growth rate, market share, earnings per share (EPS) growth can indicate the growth and expansion of your business.

- Liquidity Measures: Cash flow measures, current ratio, quick ratio, or working capital can shed light on your business's ability to meet its short-term liabilities.

Utilizing Financial Measures Effectively

Once you've identified appropriate financial measures for your BSC, follow these steps to utilize them effectively:

- Set Clear Targets: Define clear targets for each financial measure. Targets should align with your strategic objectives and be realistic yet ambitious.

- Track Regularly: Regularly monitor your financial metrics against set targets. This regular tracking enables timely detection of deviations and facilitates prompt corrective actions.

- Analyze Trends: Look beyond standalone figures and analyze trends over time. Such trend analysis can reveal underlying patterns and provide valuable insights for strategic decision-making.

- Integrate with Other Perspectives: Remember, financial measures are lagging indicators reflecting the outcomes of strategies already implemented. Hence, integrate these with leading indicators from other BSC perspectives for a comprehensive view of performance.

In summary, measuring financial performance in a BSC involves identifying appropriate financial measures, setting clear targets, and regularly tracking these measures. By doing so, organizations can align their financial goals with strategic objectives and make informed decisions to drive financial success.

Boost Financial Management with the a Balanced Scorecard Template

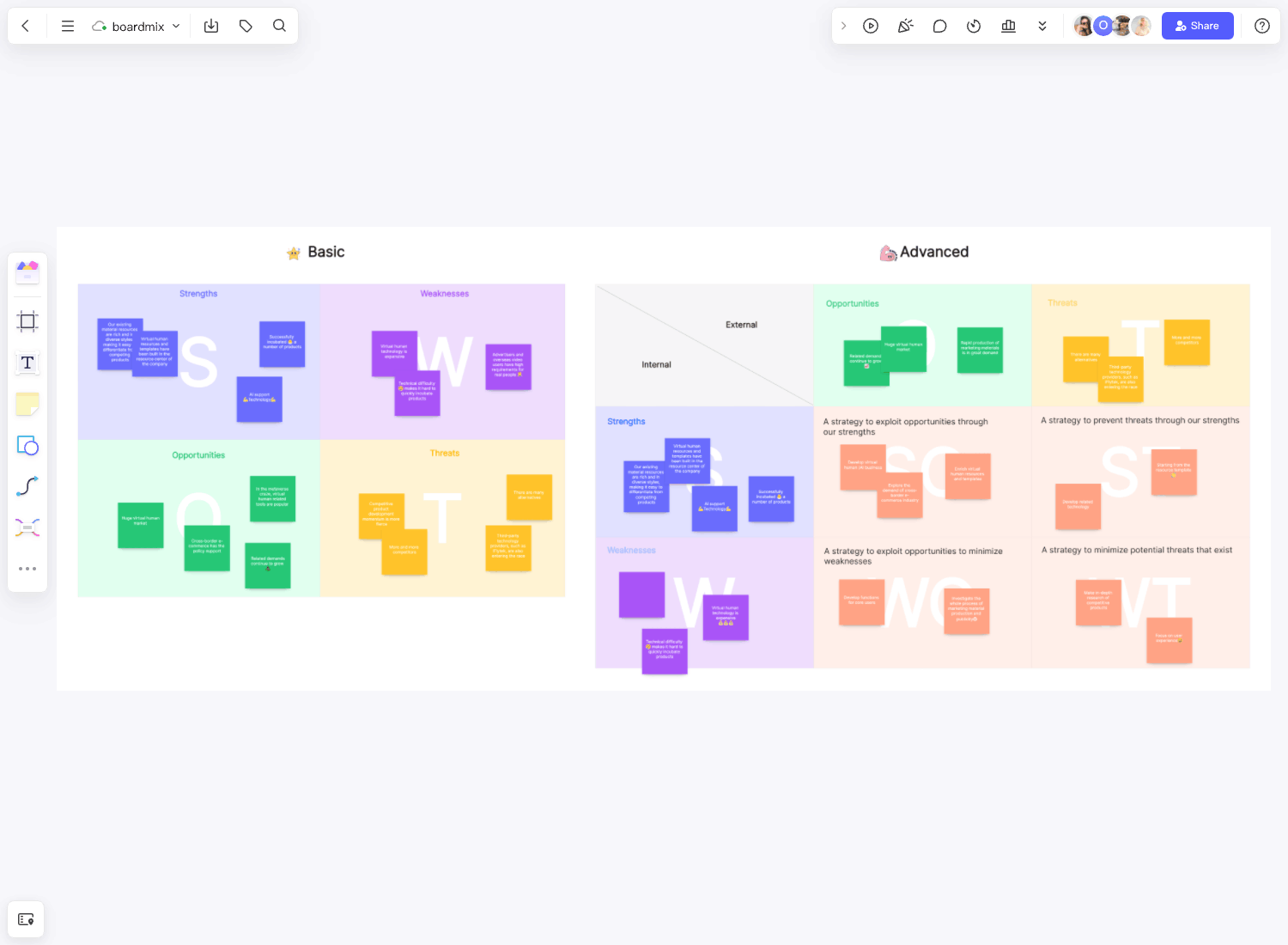

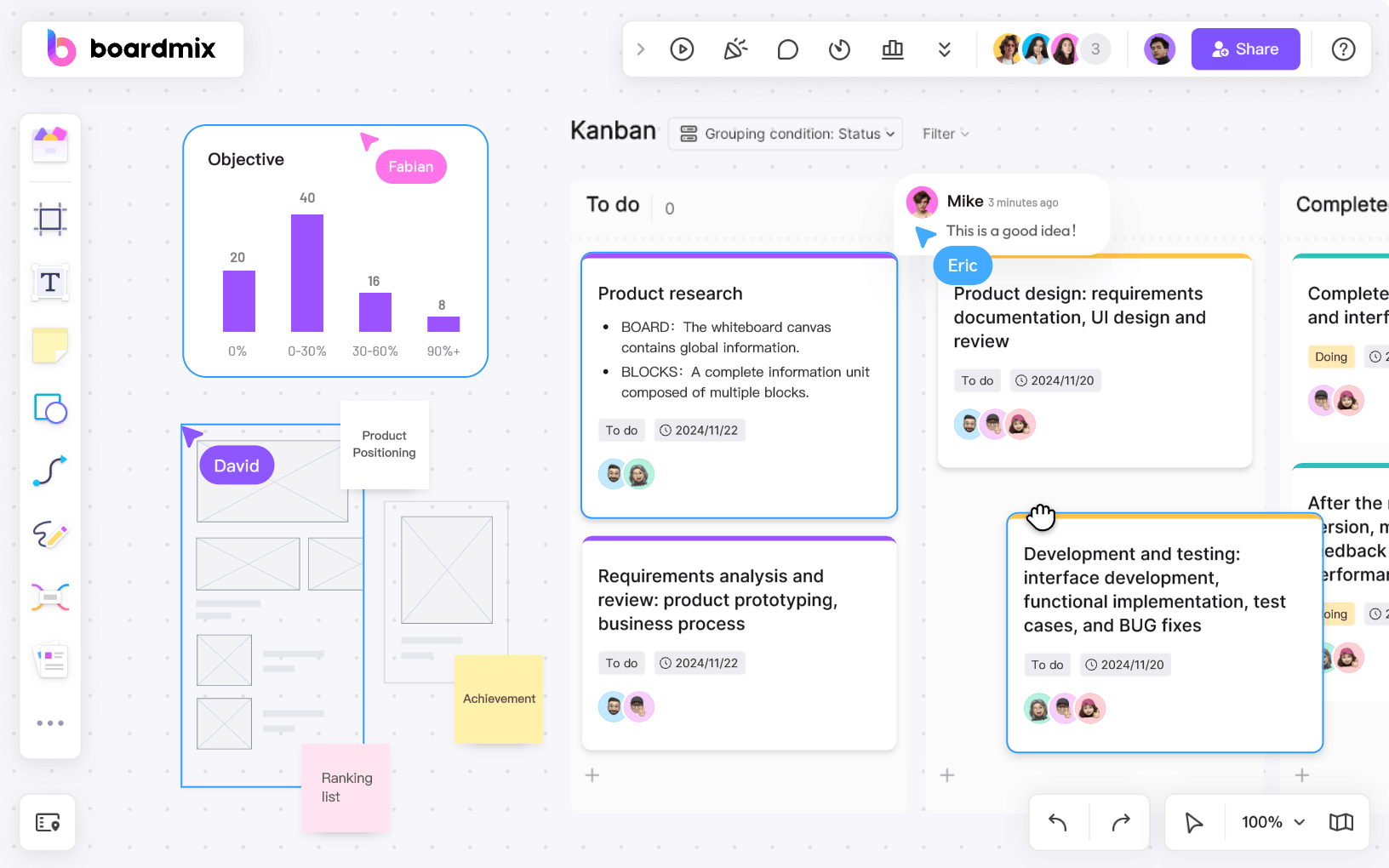

Modern businesses require dynamic tools to navigate the complex landscape of financial management. One such tool, recognized globally for its effectiveness, is the Balanced Scorecard (BSC). In the world of BSC, Boardmix's Balanced Scorecard Template stands out as an exemplary resource designed to enhance financial management and drive overall organizational success.

Understanding the Boardmix Balanced Scorecard Template

Boardmix's Balanced Scorecard Template is a digital framework designed to help businesses develop a well-rounded strategic plan. It encapsulates key areas: financial, customer, internal processes, and learning and growth, thus offering a comprehensive view of an organization's performance. What makes this template unique is its simplicity, scalability, and adaptability to any business.

Advantages of Using Boardmix Balanced Scorecard Template

Here are several ways your organization can boost financial management using the Boardmix Balanced Scorecard Template:

- Easy-to-Use: The template has a user-friendly interface that doesn't require extensive technical knowledge to navigate. This ease of use encourages consistent application across your organization, fostering strategic alignment.

- Tailored Financial Measures: It allows you to input financial measures most relevant to your organization's strategic objectives. This customizability ensures your team is focusing on metrics that directly impact financial performance.

- Holistic View: By encompassing multiple perspectives, the template encourages an interconnected view of business performance. This balanced view facilitates informed decision-making, contributing to financial success.

- Enhanced Communication: Visual representation of strategy enhances communication and understanding across your organization. Better understanding leads to improved implementation, which ultimately boosts financial outcomes.

- Scalable and Adaptable: The Boardmix template is designed to grow with your organization. Whether you're a small startup or an established corporation, this tool adapts seamlessly to your needs, making it a reliable partner in your financial management journey.

Leveraging the Boardmix Balanced Scorecard Template for Your Business

Implementing the Boardmix Balanced Scorecard Template involves a few essential steps:

- Identify Key Objectives: Start by outlining key strategic objectives for each perspective, including financial measures like profitability ratios or cash flow indicators.

- Set Targets: Define clear, measurable targets for each objective. These targets should align with your organization's overall strategic goals.

- Monitor Progress: Regularly monitor progress against set targets using the template. The visual nature of the tool aids in quick detection of deviations from desired performance.

- Engage Teams: Promote active engagement from all team members by clearly communicating the strategic plan and how each role contributes towards achieving it.

- Review and Adjust: Finally, remember that the BSC is a dynamic tool. Regularly review and adjust your objectives and measures in response to changing business environments or shifts in strategic direction.

The Boardmix Balanced Scorecard Template offers a significant edge in today's fast-paced business environment. By simplifying strategic planning and fostering alignment, this tool becomes an invaluable asset in enhancing financial management and achieving business success. Just try it out now!