Embarking on the intricate journey of financial decision-making frequently necessitates the use of a pivotal instrument - cost-benefit analysis. This exhaustive guide is designed to unravel the complexities surrounding this concept, offering in-depth understanding into its objectives, merits, potential pitfalls, and real-world utilization. It serves as a beacon for those seeking to navigate through the often murky waters of economic choices, illuminating the path towards informed and strategic decision-making.

Part 1. What Is a Cost-benefit Analysis?

Cost-benefit analysis (CBA) is a systematic approach used to evaluate the potential benefits and costs associated with a proposed project, policy, or decision. The primary goal of cost-benefit analysis is to determine whether the benefits of a particular action outweigh the costs, allowing decision-makers to make informed choices about allocating resources.

Key Concepts of Cost-benefit Analysis:

Net Present Value (NPV): NPV is a central concept in cost-benefit analysis. It represents the difference between the present value of benefits and the present value of costs. A positive NPV indicates that the benefits outweigh the costs.

Discounting: Future costs and benefits are discounted to their present value using a discount rate. This reflects the time preference for money and recognizes that a sum of money today is more valuable than the same amount in the future.

Opportunity Cost: CBA considers opportunity costs, which represent the value of the next best alternative forgone when a decision is made. It helps capture the full economic impact of a decision.

Marginal Analysis: Instead of looking at total costs and benefits, marginal analysis involves examining the incremental or additional costs and benefits associated with a small change in the level of an activity. This helps optimize decision-making.

Intangible and Non-Market Values: CBA attempts to incorporate intangible and non-market values that may not be easily quantifiable in monetary terms. These could include factors like environmental conservation, public health, and social well-being.

Distributional Impacts: CBA should consider how the costs and benefits are distributed among different stakeholders. It helps identify potential disparities and allows for a more equitable evaluation of the impacts.

Cost-benefit analysis is widely used in various fields, including economics, public policy, environmental studies, and business. While it provides a systematic framework for decision-making, it is essential to recognize that assigning monetary values to certain factors can be challenging, and the analysis may be influenced by subjective judgments and uncertainties.

Part 2. What Is the Goal of Cost-benefit Analysis?

The goal of cost-benefit analysis (CBA) is to provide a systematic and comprehensive framework for evaluating the economic desirability of a proposed project, policy, or decision. The overarching objective is to determine whether the benefits derived from a particular course of action exceed the associated costs, allowing decision-makers to make informed choices about resource allocation. Here are the key goals of cost-benefit analysis:

- Efficient Resource Allocation: CBA aims to guide decision-makers in allocating resources efficiently. By comparing the total present value of benefits to the total present value of costs, it helps identify projects or policies that offer the greatest overall net gain for society.

- Maximization of Social Welfare: The primary goal is to maximize social welfare or societal well-being. This involves considering not only economic factors but also non-monetary aspects, such as environmental quality, public health, and social equity.

- Informed Decision-Making: CBA provides decision-makers with a structured and quantitative approach to assessing the consequences of different alternatives. It helps in making informed choices by systematically weighing the pros and cons of each option.

- Optimization of Policy and Project Design: The analysis encourages the optimization of policy and project design. Decision-makers can adjust project parameters, such as scale or scope, to enhance overall efficiency and effectiveness.

- Risk and Uncertainty Management: CBA incorporates sensitivity analysis to address uncertainties and risks associated with the project or policy. Decision-makers can assess the impact of changes in key variables and develop strategies to manage uncertainty.

- Accounting for Intangible and Non-Market Values: CBA strives to capture intangible and non-market values that may not be reflected in traditional financial measures. This includes factors like improved quality of life, environmental preservation, and social cohesion.

- Comparative Analysis of Alternatives: The analysis facilitates the comparison of different alternatives. Decision-makers can evaluate various options to determine which one offers the best balance between costs and benefits.

- Equitable Distribution of Impacts: CBA considers the distributional impacts of a decision, identifying how costs and benefits are distributed among different stakeholders. This helps address equity concerns and promotes fairness in decision-making.

- Long-Term Sustainability: CBA encourages a consideration of the long-term sustainability of projects and policies. This involves evaluating whether the benefits are durable over time and whether the costs are justifiable in the context of future generations.

- Transparent Decision-Making Process: By providing a transparent and systematic framework, CBA helps in building accountability and understanding among stakeholders. It makes the decision-making process more transparent, allowing for scrutiny and input from various perspectives.

In summary, the goal of cost-benefit analysis is to guide decision-makers in making choices that result in the greatest overall societal well-being. It emphasizes a holistic evaluation that goes beyond financial considerations to include a wide range of economic, social, and environmental factors. However, it's essential to acknowledge the limitations and challenges associated with CBA, such as the difficulty in valuing certain non-market goods and the need for subjective judgments in the analysis.

Part 3. What Are the Benefits of Cost-benefit Analysis?

Cost-benefit analysis (CBA) offers several benefits, making it a valuable tool for decision-makers in various fields. Here are some of the key advantages of using cost-benefit analysis:

- Enlightened Decision-Making: By providing a comprehensive overview of potential outcomes, it aids in making informed and strategic decisions.

- Transparency: It promotes transparency in fiscal affairs by shedding light on the intricate details often hidden in financial jargon.

- Risk Evaluation: Cost-benefit analysis assists in risk evaluation, offering insights into potential pitfalls and challenges that may arise.

- Comparative Analysis: The comparative aspect enables weighing up different options, thereby promoting strategic choices.

- Efficient Resource Distribution: It nurtures efficient resource distribution by identifying areas where resources can be best utilized for maximum benefit.

Part 4. What Are the Limitations of Cost-benefit Analysis?

Cost-benefit analysis (CBA) has several limitations and challenges that should be considered when applying this approach to decision-making. Here are some key limitations:

- Difficulty in Valuing Intangibles: Some benefits, such as environmental preservation or improved quality of life, are challenging to quantify in monetary terms. CBA may struggle to capture the full range of intangible impacts.

- Timeframe and Discount Rate Sensitivity: The choice of the timeframe and discount rate can significantly influence results. Different discount rates may lead to different conclusions about the viability of a project, and the optimal timeframe may vary.

- Uncertainty and Future Projections: Future events are uncertain, and projections may be subject to errors. CBA relies on assumptions about future conditions, and unforeseen changes can affect the accuracy of the analysis.

- Difficulty in Measuring Non-Market Benefits: Non-market benefits, like improvements in health or education, can be challenging to measure accurately. This difficulty can lead to incomplete assessments of the overall impact.

Part 5. When to Do a Cost-Benefit Analysis

Cost-benefit analysis (CBA) is a valuable tool, but it may not be necessary or practical for every decision or project. Here are situations where conducting a cost-benefit analysis is particularly useful:

- Major Investments: Assessing whether benefits justify large-scale project costs.

- Public Policy Decisions: Evaluating economic impacts of government policies and projects.

- Environmental Impact Assessments: Weighing environmental costs against economic benefits.

- Business Investments: Evaluating potential returns for significant business decisions.

- Resource Allocation Decisions: Prioritizing projects based on return on investment.

- Regulatory Compliance: Assessing costs and benefits of meeting regulatory requirements.

CBA is especially valuable in these scenarios, helping decision-makers make informed choices about resource allocation, policy formulation, and project viability.

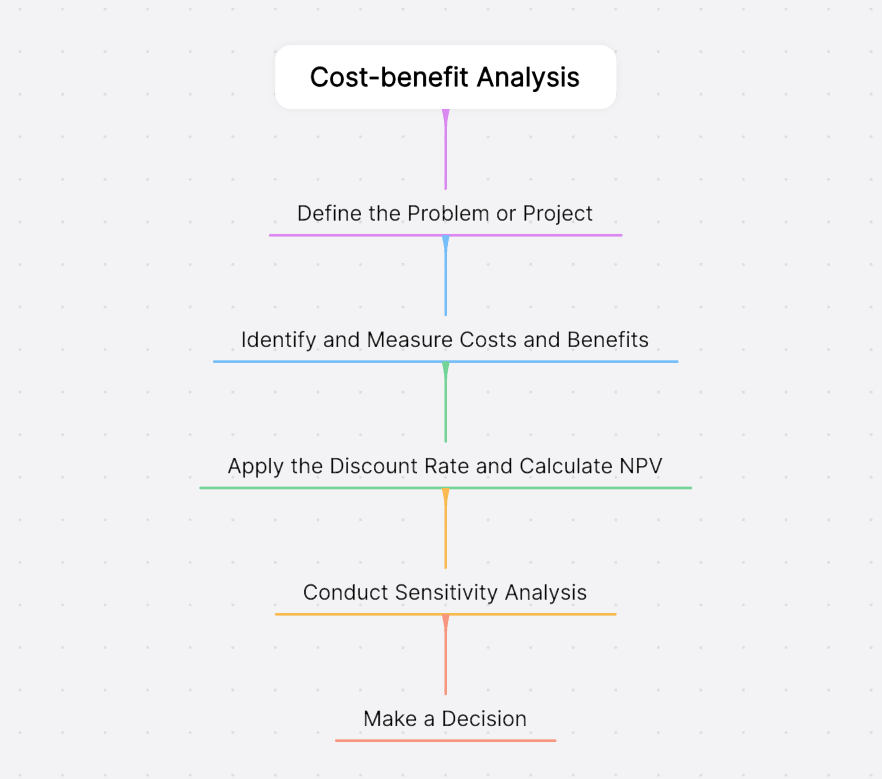

Part 6. What Are the 5 Steps of Cost-Benefit Analysis?

The cost-benefit analysis (CBA) process typically involves the following five steps:

- Define the Problem or Project: Clearly state the problem or project goals, outlining alternatives and stakeholders.

- Identify and Measure Costs and Benefits: Enumerate and quantify all relevant costs and benefits associated with each alternative.

- Apply the Discount Rate and Calculate NPV: Discount future values, considering the time value of money, and calculate the net present value (NPV).

- Conduct Sensitivity Analysis: Assess the impact of variations in key variables and assumptions.

- Make a Decision: Compare NPVs; if positive, proceed with the project; if negative, reconsider viability.

These steps guide decision-makers through a structured process, facilitating informed choices based on economic considerations.

Part 7. How Boardmix Can Help with Cost-Benefit Analysis?

Boardmix, a groundbreaking online whiteboard solution, is poised to revolutionize your cost-benefit analysis process. It brings to the table an array of features designed to make complex analyses more manageable and collaborative.

Here are the key features that set Boardmix apart:

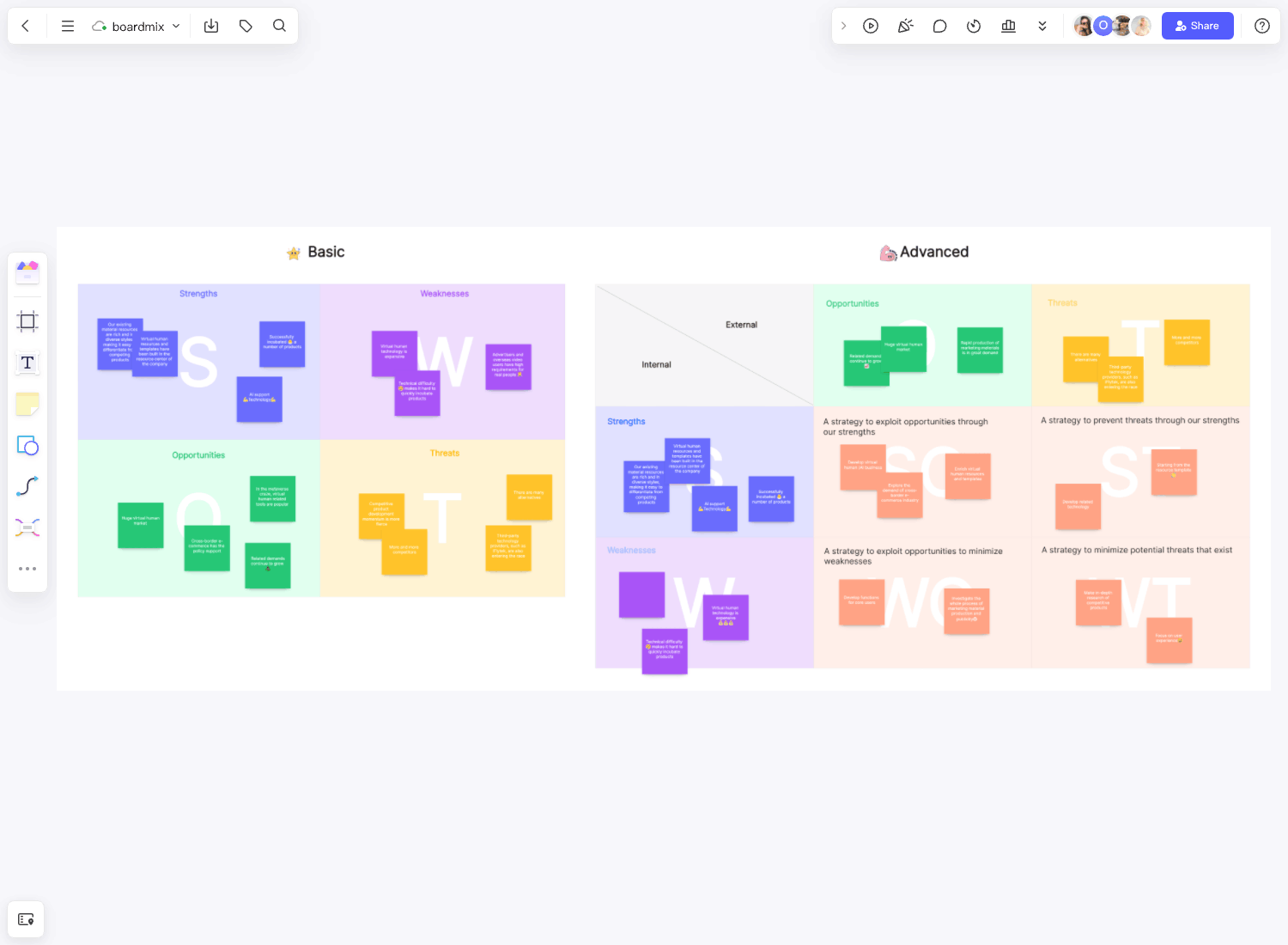

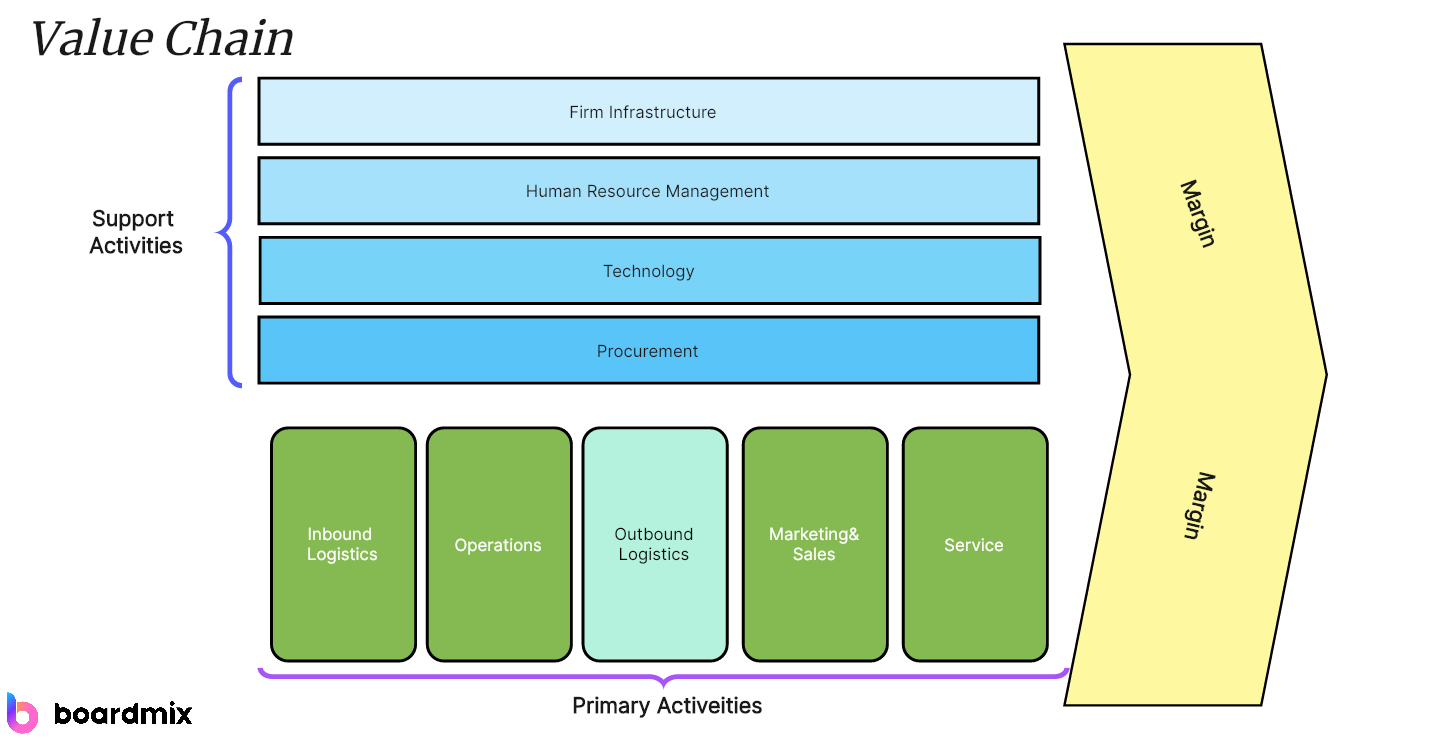

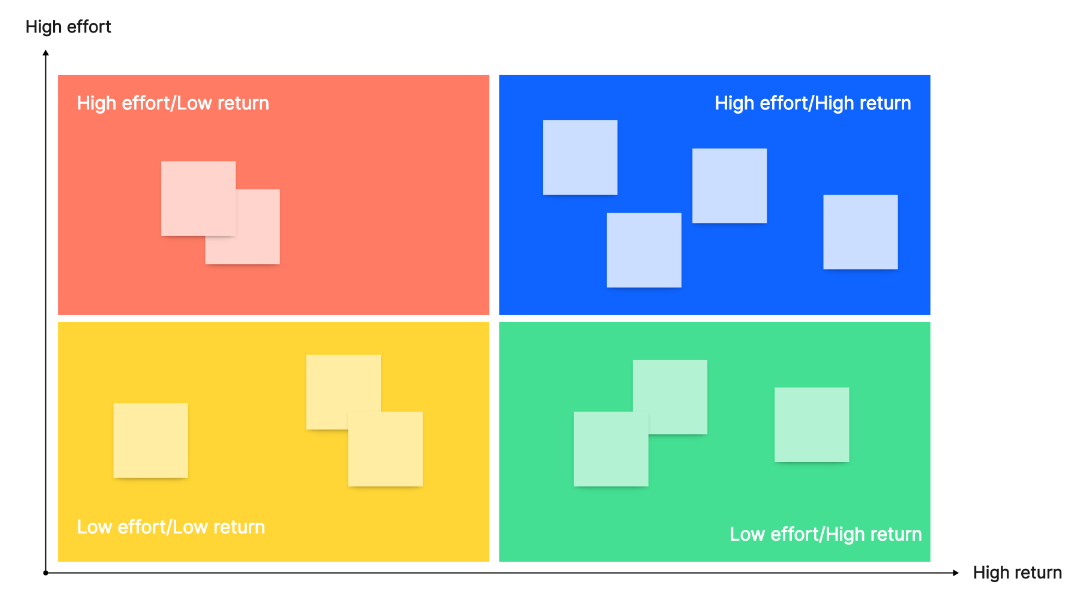

- User-Friendly Drawing Templates: Boardmix offers a plethora of easy-to-use drawing templates, enabling users to visually represent intricate data in a simplified manner.

- Real-Time Collaboration Capabilities: Boardmix fosters team-based analyses by providing real-time collaboration tools, allowing multiple users to work together seamlessly on the same project.

- Cloud-Based Storage: With its cloud-based storage feature, Boardmix ensures easy access and sharing of data anytime, anywhere, enhancing flexibility and efficiency.

- Intuitive User Interface: The platform boasts an intuitive user interface that allows for seamless navigation, making it easy even for first-time users to navigate through the tool effectively.

- Robust Security Measures: Understanding the importance of data protection, Boardmix implements robust security measures to safeguard your sensitive information from potential threats.

With these features at your disposal, conducting cost-benefit analysis becomes not just simpler but also more efficient and effective with Boardmix.

Conclusion

Grasping and proficiently employing cost-benefit analysis can considerably amplify the quality of your decision-making process. It's a powerful tool that, when wielded correctly, can transform complex financial decisions into strategic moves towards success. With innovative tools like Boardmix within your reach, you have the ability to traverse this intricate yet indispensable facet with simplicity and confidence. Boardmix not only simplifies the process but also optimizes efficiency and productivity, making it an invaluable asset in your arsenal for informed decision-making.